P3-Digital-Currency

Post 3

Dated 4/5/2020;

Digital Currency & transactions.

Snippet:

CBS, Digital payments(real time, defferd),UPI,Atms,MDR,NPCI(National Payments corporation of India)

Now when we’ve seen the money evolving from barter to coins them to paper currency , now we’ll dive deeper into the banking and electronics payments.

Banking systems use software called CBS (core banking solution). In Indian banks this software is generally “finnacle” developed by Infosys. This CBS allows a bank teller to access your account from any branch of the Bank. This is also the software that hosts your Net banking websites.

Now all the digital transactions are of two types.

- Real Time (instant or almost instant)

i) Imps(Immediate payment service)

a) Availability : :24x7

b) Min amount ::any

c) Max amount ::10 Lakhs

d) Charges(GST extra):5-15

e) Operator ::NPCI(National Payments corporation of India)

ii) RTGS(Real Time Gross settlement)

a) Availability : :7am-6pm(bank days)

b) Min amount : :2Lakhs

c) Max amount : :variable generally 500cr

d) Charges(GST extra):25-50

e) Operator ::RBI

- Deferred( delayed or periodic)

i) NEFT(National Electronic Fund transfer)

f) Availability : : 7am-6pm(bank days)

g) Min amount :: 1

h) Max amount ::10Lakh

i) Charges(GST extra):2.5-25

j) Operator ::RBI

ii) NECS(National Electronic clearing Service)

Hosted by RBI

iii) NACH(National Automated Clearing House)

Hosted by NPCI(National Payments corporation of India)

Both of NECS and NACH are used for clearing bulk transfers like scholarships, salaries etc

Have you ever visited a ATM (automated teller machine)

Obviously You’ll need an ATM card but here’s a catch

ATM cards are of Two types :

- Debit Card : It is a basic card linked with your Savings account and money is directly debited from your acoount.

- Credit Card: It is a card where we can avail short term loans during a cash crunch, It is interest free for about 45 days, But don’t forget to clear payment on time coz it invites heavy Interest afterwards. The amount that can be taken depends on your Credit rating (will discuss later)

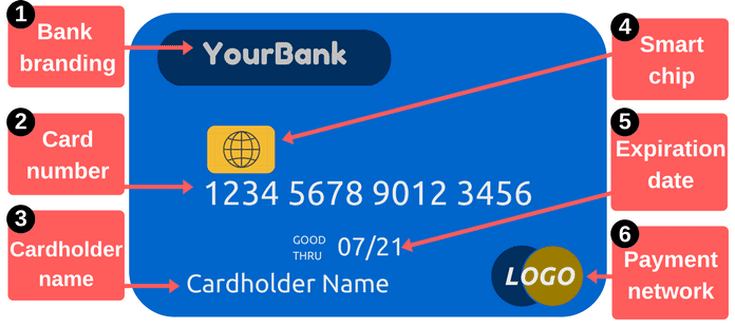

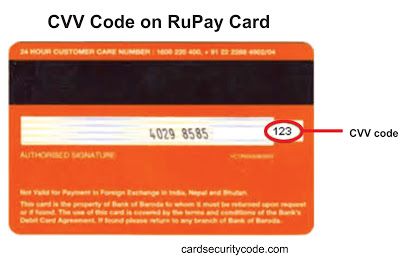

The features of a Card are visually shown

there is a card number with the owners and issuing bank’s name and a expiry date. The reverse side is required to be signed for POS transactions, the data is saved on a black magnetic strip, but new cards are being issued which have a smart chip that avoid fraudsters to clone your card.

Keep it in a safe place and don’t do the common stupidity of writing your pin somewhere

The features of a Card are visually shown

there is a card number with the owners and issuing bank’s name and a expiry date. The reverse side is required to be signed for POS transactions, the data is saved on a black magnetic strip, but new cards are being issued which have a smart chip that avoid fraudsters to clone your card.

Keep it in a safe place and don’t do the common stupidity of writing your pin somewhere

It is an electronic box sitting in an air conditioned room and dispense money, what a comfortable life of a Box indeed :). ATM’s are installed by banks for quick service at following aspects;

- Cash Withdrawal & deposit

- Account statement

- Pin change etc

ATM’s are also classified as follows: - Bank Label : hosted and operated by bank itself

- White label : hosted and operated by non bank entity

- Brown label : Outsourced but operated by bank

White label ATM’s are quite new for India and can be seen hosted by a NON BANK firm like Muthoot Finance

ATM also runs on a software but how?

The software of ATM derives it’s data from the CBS of bank and operates on several platforms like:

Linux -> software by Vortex

White label ATM’s are quite new for India and can be seen hosted by a NON BANK firm like Muthoot Finance

ATM also runs on a software but how?

The software of ATM derives it’s data from the CBS of bank and operates on several platforms like:

Linux -> software by Vortex

Win 7->software by Hitachi

CDAC-> runs on BOSS(Bharat operating system solution)

But wait the role of your ATM card isn’t over yet, Lets go shopping but cashless, but HOW??

The ATM card can also be used to pay at merchant using a device called POS(point of sale)terminal where a merchant uses a device to swipe your card and proceeds with the transaction. The Newly launched Rupay card is a indigenous card network which is cost effective and provides faster transaction. Unlike VISA and MASTERCARD where the transaction goes through a foreign server and that service provider charge a higher rate, Rupay is all ‘desi. But it doesn’t work with Netflix and Prime

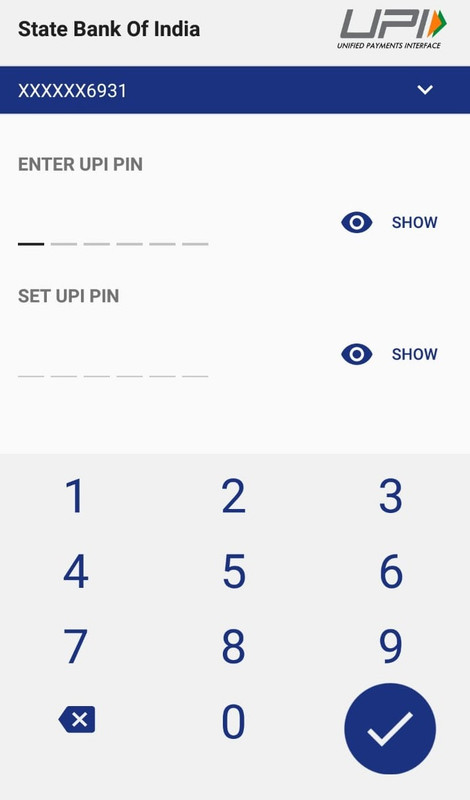

Now Let’s switch our focus to the latest fad : UPI UPI stands for Unified Payment Interface , it is a unique initiative taken by the NPCI and has reached to masses in no time. Here the NPCI has made a secure backend platform usually referred to as UPI. This platform is used by various companies like Google(Google Pay), Amazon(amazonpay) and by various banks to build their UPI apps.

So in a UPI application we can link our savings Bank Ac and decide a PIN to secure it just like in ATM. Now a Vpa ID (virtual Payment ID ) is generated which can be used to pay and receive money instantly ,we can also share bills with our friends(make them register ASAP) and check account balance, If you’ve ever used one You’ll notice the screen below, this is common in all apps because the basic processing backend is same for all the UPI apps.

Something about NPCI:

National Payments corporation of India is a section-8(refers to rules in companies act) not for profit company and has 56 promoter Banks for funding and running the company.