P12-Trading-vs-Investing

post 12

Dated13/5/2020

Trading vs Investing

snippet Today we will define the fundamental differences between trading and investing.

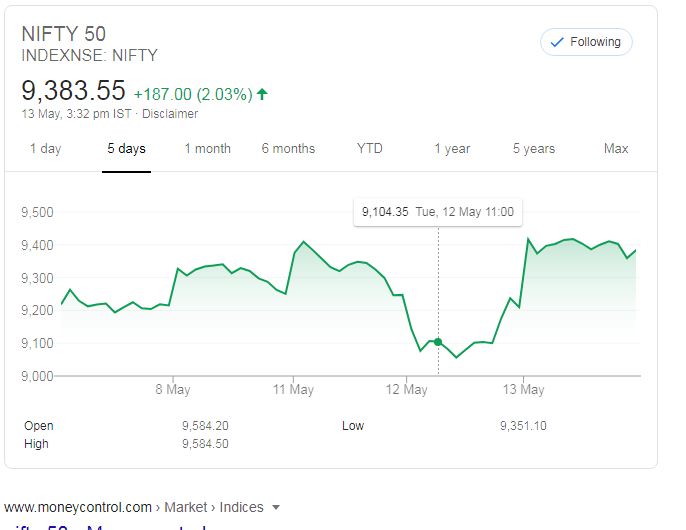

This is often a general confusion and a public notion that trading and investment are similar terms. But these have a lot more subtle differences. lets see this through a plot

the general trend of Nifty over the years is more or less growing, But if we zoom in and see, We will see a lot of ups and downs,

The difference between a trader and investor is the mindset of booking profits, A trader has to trade sucessfully between the short term fluctuation of prices but an investor would seek the company to grow along with his money. The investor would always plan for a long run and is generally associated with lower risk as compared to an investor. Because the longer time slowly averages out the chances of risk.

Now the trader has his definitions of time reffered as.

- Intraday: Where a trader purchase or sell some shares and square off within one day (squaring off : within a day coming back to initial holding,like you’ve purchased something and you are required to sell that same day.)

- Swing: Where a trader holds a position for a few days ranging in fortnights.

But an investor seeks refuge in Long term capital gain and is not affected with daily changes, But investor believes in the Fundamental analysis and a strong base of a company, Whereas a trader can ignore the fundamental analysis and can even purchase companies that are fundamentally weak but are driven by market mentality for a day trade.

now both of these are to be taxed accordingly and the Indian taxation defines two types of Taxes, One for each of these:

- Short term capital gains Tax: Here the profit is added to income and person is taxed according to income brecket

- Long term capital gains : If a perosn holds a Equity for more than 1 year or a debt Mutual fund for more than 3 years then this is applicable and this stands at 10% , earlier it was 0% but is recently reintroduced :(.

Now along with the difference in mentality, there is difference in the analytical approach towards a company also. This is seen as below

-

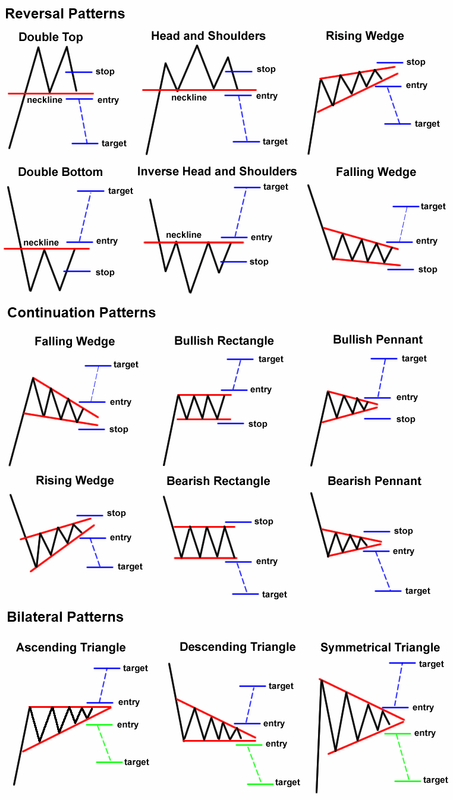

Technical Analysis is a analytical approach to study the plot and guess the pattern which a stock might be forming to form a position accordingly,

Here are some interesting patterns

- But the Investor has not much interest in the daily impuslive movement and investor relies on his own study reffered to as fumdamental analysis which evaluates the company’s basic structure on following bases.

- Profitability Analysis : How well can a company generate profits utilizing its resources

- Liquidity Analysis : How much cash in hand or liquid assets does a company has to continue day to day operations

- Activity Analysis : How efficiently can a company generate sales from capital it employs.

- Solvency Analysis : How efficiently company would covet long term debt

I hope that you can now clearly differentiate and choose a suited path . either you would invest or trade to earn a fortune

Happy learning